Benefits of Starting a Business in Spain

01Spain has a robust economy

01Spain has a robust economy-

02It serves as an international business and trade hub

02It serves as an international business and trade hub -

03There is a solid infrastructure and networks

03There is a solid infrastructure and networks -

04There is a strong focus on investment, research and development

04There is a strong focus on investment, research and development -

05The rise of technology and innovation

05The rise of technology and innovation  06Simpler procedures and lower tax burden

06Simpler procedures and lower tax burden 07The domestic market is attractive

07The domestic market is attractive 08It has strong economic sectors (Tourism/Renewable Energy)

08It has strong economic sectors (Tourism/Renewable Energy) 09It has favourable laws for foreign investors

09It has favourable laws for foreign investors 10Strategic geographical location

10Strategic geographical location

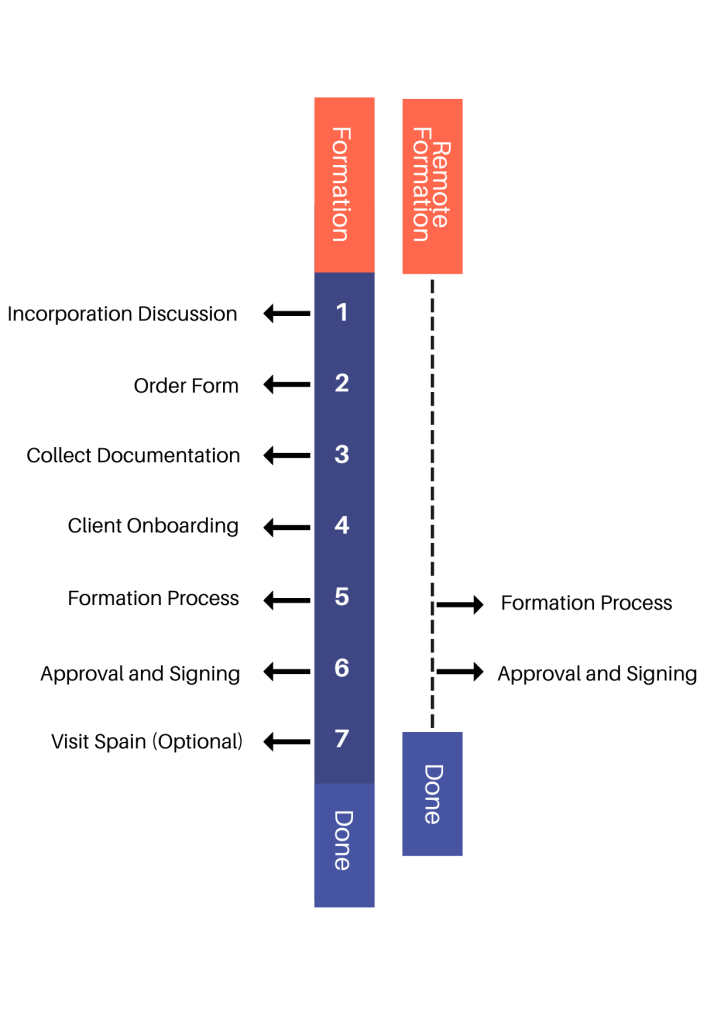

Company Formation Spain – How to Begin

With incorporation services from Bolder Launch, company formation in Spain is a breeze. Still, there are things you need to consider, such as the annual audit, financial reporting and statutory filing requirements. We can help you avoid missing documentation, legal, tax, accounting and regulatory rules! We will help you formulate the best corporate structure for your company in Spain and ease the entire process into simple steps that include:

01Name Search

01Name Search-

02Due Diligence review

02Due Diligence review  03Company Registration

03Company Registration 04Preparation of the corporate kit box with all statutory documents

04Preparation of the corporate kit box with all statutory documents  05Preparation of the management account and financial report

05Preparation of the management account and financial report

Contact us for a free consultation, and quote, to see what the required solution would be for your firm.

Common Types of Business Structures in Spain

Limited Liability Company (Sociedad Limitada/SL)

This legal structure is the most used figure for our clients and is the most used type of company in Spain.

Stock Corporation or Public Limited Liability Company (Sociedad Anonima/SA)

This legal structure in Spain is ideal for large listed companies and it also has limited liability for the shareholders.

Branch office

This is the right option in case you already have your company abroad and would like to start operating in Spain.Spain Company Formation s in 6 easy steps!

Please note that before the official launch of your Spanish company’s operations, you must notify the Ministry of Labour and Social Economy. Bolder Launch can also assist you with remote or online company registration. It will take around two to three working days to complete the company set up in Spain. Additional charges for expedited services apply.

Requirements in Spain company formation

The following is a general list of requirements for establishing a business in Spain, but there may be additional requirements depending on the legal structure.

01Address in Spain

01Address in Spain-

02Company bylaws

02Company bylaws -

03Company deed certified by a Notary

03Company deed certified by a Notary -

04Designated company director and administrator

04Designated company director and administrator -

05A resident staff member in Spain

05A resident staff member in Spain  06Share capital

06Share capital 07Personal Identification numbers (NIE or DNI)

07Personal Identification numbers (NIE or DNI)  08Company identification number (NIF)

08Company identification number (NIF) 09Social Security number

09Social Security number

For a branch office or subsidiary:

01Extraordinary Shareholders’ Meeting

01Extraordinary Shareholders’ Meeting-

02Company deed certified by a Notary

02Company deed certified by a Notary -

03Notarised Power of Attorney for the representative

03Notarised Power of Attorney for the representative -

04Copy of the existing company’s certificate of incorporation

04Copy of the existing company’s certificate of incorporation -

05Certificate of good standing

05Certificate of good standing  06A resident staff member in Spain

06A resident staff member in Spain  07Company identification number (NIF)

07Company identification number (NIF)

Spain Company Formation – Why Work with Bolder Launch?

Our goal from the moment you contact us is to simplify, add transparency and make Spain Company Formation as affordable as possible. We understand how complex running a business can be, especially for foreign entrepreneurs. That’s where we help steer the process in the best course of action and ease it by setting out all options and recommendations for you.

We take immense pride in our entrepreneurial approach to starting a business in Spain, which is flexible and meticulous. Work with us and we guarantee fast, fair and responsive incorporation service.

01Our Group has served over 10,000 clients since 1982

01Our Group has served over 10,000 clients since 1982-

02We have a global team of more than 350 staff members.

02We have a global team of more than 350 staff members.

Commercial Director Bolder Europe

Currently involved in business development projects for international firms entering the Spanish market.

Our Spain Company Formation Services

Bolder Launch provides incorporation services for all kinds of businesses looking for expanding avenues in Spain. We can help SMEs and multinational companies from around the world to set up and accomplish business goals in Spain. Our extensive services include:

01Spain has a robust economy

01Spain has a robust economy 01Name Search

01Name Search